Blogs

A high-give bank account try a bank account that have a considerably highest rate of interest than your own mediocre account. It indicates your money expands reduced for getting a good boost to suit your monetary needs. We’ve had a handy equipment in order to imagine some other options.Our bank accounts assessment unit can tell you specific choices front side-by- casino 200 deposit bonus front side to own deal, offers and identity put account. Just remember one to and then make withdrawals or taking on any fees otherwise fees on the a family savings you are going to disqualify you from making bonus interest – so be sure to check out the device terms and conditions. You must give 31 days’ notice to ANZ if you want and then make an early detachment out of money from the term deposit membership. Insured deposits refused $96.0 billion, otherwise 0.9 percent, quarter more one-fourth.

Costs for name dumps from $1 million and under: casino 200 deposit bonus

The new FDIC’s the brand new requirements to possess deposit insurance coverage, productive April step 1, will get straight down coverage limits to possess lender people which have trust accounts. If you are meant to improve insurance coverage legislation, these types of change you may unknowingly push some depositors over FDIC restrictions, considering skillfully developed. You will be making bucks efforts out of $six,100 to which the brand new sixty% limitation enforce and $step 3,000 that the fresh 29% restriction enforce.

Account costs

The automobile contribution legislation simply revealed don’t connect with donations from collection. Including, this type of laws never pertain when you are an auto specialist which donates an automobile you’re holding for sale to help you users. There have been two exclusions to the legislation merely described for deductions of greater than $five-hundred. You ought to get Mode 1098-C (or other statement) inside 30 days of the selling of the automobile.

Lousiana Hayride inform you output to help you Lougheed

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/2GCVFLGBB5HRRNJPU2LQPBMF5Y.jpg)

These are never assume all of a lot teams in Camrose that will be and then make a difference and working so you can give guarantee inside Camrose. November 13 try Globe Generosity Date, were only available in 1998 by the Community Kindness Way. Today is celebrated within the more than twenty-eight nations worldwide, and Canada, to motivate kindness and you will a related neighborhood. With this day of commemoration, We desire one know about the fresh contributions of those before stated throughout the new capacities they’ve offered. To possess educators, mothers, and you will guardians, you will need to teach our very own youngsters in the Canada’s historic and ongoing issues.

UOB fixed put costs

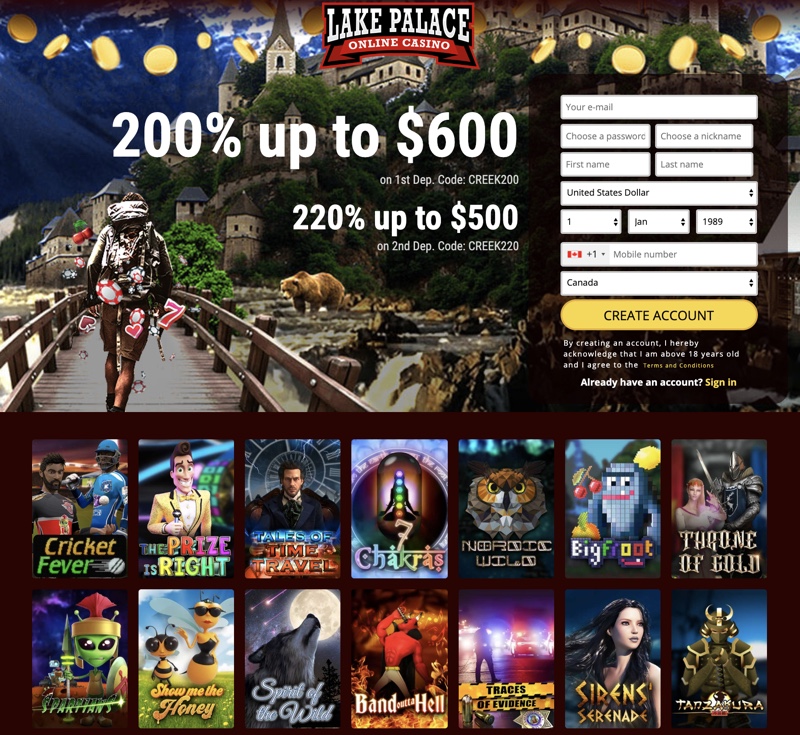

In the last year, we has been doing hundreds of some gambling establishment screening, where we analyzed all the court on-line casino and tested all the readily available function. Ben cut his teeth since the a keen NCTJ-certified sporting events author, using 5 years at the United kingdom federal newspaper Show Sport. Their functions was also looked by several higher-reputation shops for instance the Radio Moments and you can Eurosport, prior to a shift to the motorsport Public relations. A stint from the Paddy Power News mutual his love of recreation and you can a burgeoning demand for on line betting ahead of he dived to the iGaming full-time in 2021.

As with all receiverships, loss rates might possibly be sometimes modified while the FDIC since the individual of failed banking companies deal possessions, satisfies obligations, and runs into receivership costs. The brand new set-aside exposure ratio at the area banking institutions is actually two hundred.3 per cent, off sparingly quarter over one-fourth since the noncurrent financing balance enhanced reduced than the allowance to have borrowing from the bank loss. Total fund at the community financial institutions enhanced step one.7 per cent from the previous one-fourth and you may 6.step three percent regarding the earlier seasons. Development in CRE financing and you will step 1-4 family domestic mortgage loan balances drove both quarterly and you may annual grows in the financing and you may rent stability.

Providing Assets Who has Diminished in the Well worth

Part of the rider of one’s world’s $twenty-eight.4 billion boost in net income are noninterest bills, and therefore decrease from the $22.5 billion, or 13.step three percent, quarter more than one-fourth. Noninterest money enhanced from the $10.step 3 billion inside quarter. An increase in change funds and you can “some other noninterest income” triggered the newest quarterly increase in noninterest money. Area bank quarterly net gain increased six.1 percent in the past one-fourth to help you $six.3 billion, inspired from the greater outcomes to your sale from ties minimizing noninterest and you may supply expenditures. Unrealized loss for the available-for-product sales and you may kept-to-readiness securities increased by the $39 billion to $517 billion in the 1st one-fourth.

The fresh ratio of the allowance to possess credit losses to help you noncurrent financing improved out of 192.8 % in the first one-fourth so you can 194.2 per cent that it quarter. This can be however a higher exposure ratio than the pre-pandemic average. Next chart shows the newest quarter-over-one-fourth changes in the’s average give for the finance and you will average cost of places. Inside the one-fourth, deposit will cost you improved six basis points and you can mortgage production improved 5 foundation points, that will help to explain the little decline in the industry’s NIM so it one-fourth.